In today’s fast-paced business environment, having the right accounting software in Canada is crucial for the success and growth of small and medium-sized businesses (SMBs). Whether you’re a startup or a growing company, the ability to manage finances efficiently, stay compliant with Canadian tax regulations, and have access to real-time financial data can significantly impact your bottom line.

Choosing the right accounting software in Canada can be a game-changer for your business. With the complexities of GST/HST, payroll regulations, and bilingual requirements for businesses operating in both French and English, Canadian companies need specialized solutions tailored to these needs. Fortunately, the market offers a variety of accounting software in Canada that cater to businesses of different sizes and industries, helping them streamline their financial operations.

In this article, we will explore the top 5 accounting software in Canada for SMBs, including Business Central, a leading choice for growing businesses looking for scalability and advanced functionality. Whether you're looking for a simple solution for invoicing or a more comprehensive system to manage inventory and payroll, the right accounting software in Canada can help you navigate your financial challenges with ease.

With that said, let’s dive into the challenges SMBs face in Canada and how the best accounting software in Canada can help overcome these hurdles.

Accounting challenges faced by SMBs and how accounting software in Canada can help

Small and medium-sized businesses (SMBs) in Canada face unique financial challenges that require the right tools to manage effectively. Without proper accounting software in Canada, companies can struggle to keep up with the complexities of tax laws, cash flow management, and bilingual reporting requirements. Here are some of the key challenges that SMBs encounter and how the right accounting software in Canada can address these issues:

Tax compliance

Canadian businesses must navigate complex tax regulations, including GST, HST, and PST, which can vary by province. Keeping track of these varying tax rates and ensuring accurate reporting is a major challenge for SMBs. Accounting software in Canada helps automate these calculations, ensuring that your business remains compliant with federal and provincial tax laws.

Cash flow management

Managing cash flow is crucial for the survival of SMBs. Without clear visibility into your financial health, it’s difficult to track incoming revenue and outgoing expenses, leading to cash shortages. The right accounting software in Canada provides real-time financial insights, enabling businesses to monitor cash flow, forecast financial trends, and make informed decisions.

Payroll and CRA compliance

Payroll in Canada comes with its own set of rules, such as source deductions for the Canada Pension Plan (CPP), Employment Insurance (EI), and tax withholdings. Compliance with CRA regulations is non-negotiable, and mistakes can lead to penalties. Accounting software in Canada can automate payroll processes, calculate withholdings, and ensure accurate remittances to the CRA.

Bilingual requirements

For businesses operating in Quebec or with French-speaking clients, it’s essential to have accounting software that supports bilingual functionality. Having accounting software in Canada that offers both English and French interfaces ensures smooth communication and reporting, which is crucial for businesses in bilingual regions.

Scalability and growth

As SMBs grow, their accounting needs become more complex. Many businesses outgrow basic software and need a more robust solution that can handle inventory management, multi-currency transactions, and advanced financial reporting. Choosing the right accounting software in Canada that can scale with your business ensures you won’t face limitations as you expand.

In the next section, we’ll explore the top 5 accounting software in Canada that can help SMBs address these challenges and streamline their financial operations.

Top 5 accounting software in Canada for SMBs

When it comes to managing finances, SMBs in Canada have a wide range of accounting software options available, each offering unique features tailored to different business needs. Here’s a closer look at the top 5 accounting software in Canada, including both well-known names and specialized solutions for businesses that need more advanced tools.

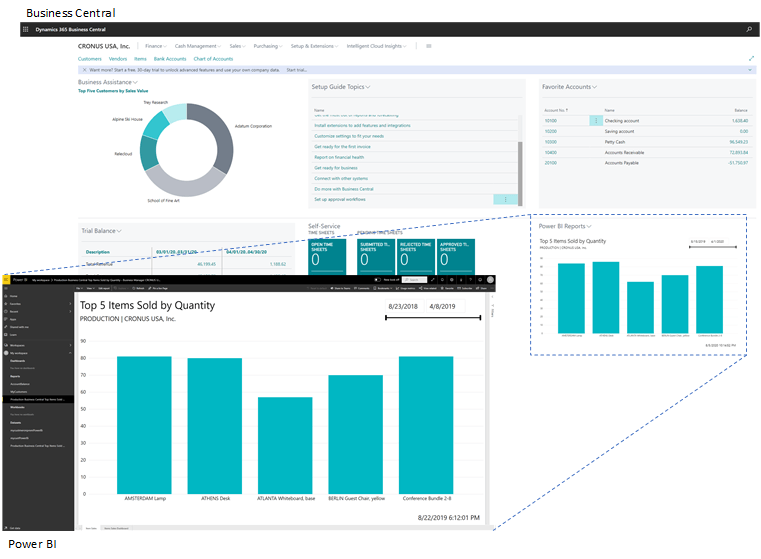

1. Microsoft Dynamics 365 Business Central

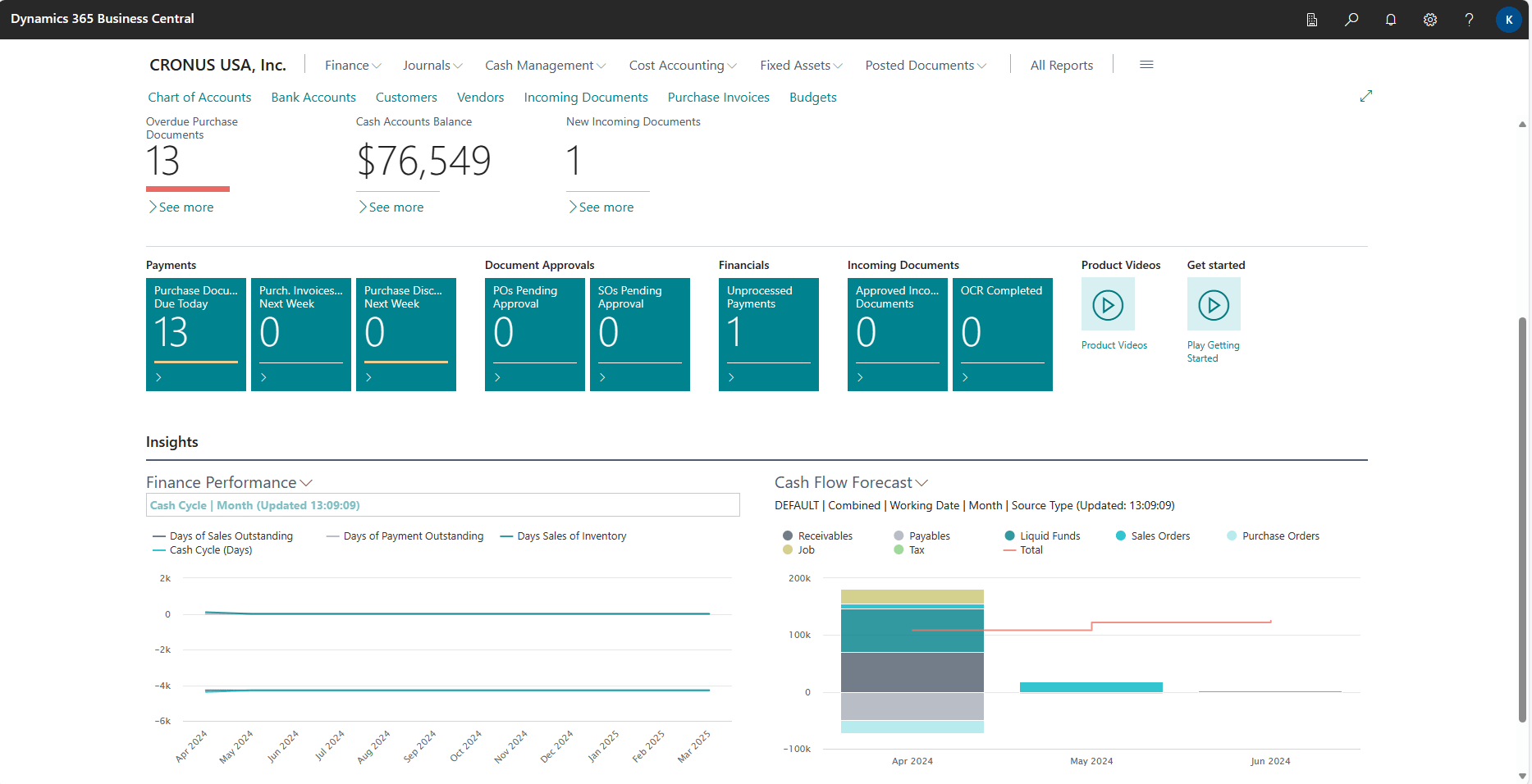

- Overview: Business Central is more than just accounting software—it's a comprehensive enterprise resource planning (ERP) solution that helps businesses manage finances, operations, and inventory in one integrated platform.

- Key features: GST/HST and payroll compliance tailored to Canadian regulations. Multi-language support (English and French) for businesses operating in Quebec. Advanced financial reporting, budgeting, and forecasting. Seamless integration with other Microsoft products like Power BI, Excel, and Outlook. Scalability to grow with your business, offering a full ERP suite beyond basic accounting.

- Why it’s a top choice for SMBs: For businesses that need more than basic accounting, Business Central offers powerful financial management tools combined with broader operational capabilities, making it a top choice for growing Canadian businesses.

2. QuickBooks Online

- Overview: QuickBooks is one of the most popular accounting software options for small businesses, offering a user-friendly interface and powerful basic features.

- Key features: Automatic GST/HST tracking and filing. Simple invoicing, expense tracking, and bank reconciliation. Integration with a wide range of third-party apps to extend functionality. Mobile app for managing finances on the go.

- Why it’s a top choice for SMBs: QuickBooks Online is perfect for startups and small businesses with straightforward accounting needs. It’s easy to use, affordable, and offers essential tools for financial management.

Case study

Discover how Bédard Ressources made its accounting more efficient with Business Central

3. Sage 50cloud (formerly Simply Accounting)

- Overview: Sage 50cloud is a trusted accounting software solution with a strong presence in the Canadian market, offering desktop and cloud access for flexibility.

- Key features: In-depth payroll management, tax compliance, and reporting for Canadian businesses. Inventory management features, making it ideal for product-based companies. Multi-currency functionality for businesses with international clients. Strong security features for protecting sensitive financial data.

- Why it’s a top choice for SMBs: Sage 50cloud combines the familiarity of desktop software with the flexibility of cloud access, making it ideal for businesses that want robust financial management tools with added flexibility.

4. Xero

- Overview: Xero is a cloud-based accounting software that offers a clean, easy-to-use interface and strong financial reporting tools.

- Key features: Multi-currency support and simple expense management. Automated GST/HST calculations and tax filing for Canadian businesses. Extensive integration with third-party applications like payment processors and CRMs. Real-time bank reconciliation and cash flow tracking.

- Why it’s a top choice for SMBs: Xero is perfect for small to medium-sized businesses with international clients or multiple revenue streams. Its intuitive design and cloud-based access make it a convenient choice for businesses looking for flexibility and global functionality.

ERP self-evaluating guide

Optimize your ERP software performance by identifying potential areas for improvement through our practical guide.

Download

Download

5. FreshBooks

- Overview: FreshBooks is designed with service-based businesses in mind, offering simplified invoicing, time tracking, and expense management tools.

- Key features: Customizable invoices and automated payment reminders. Time tracking for projects, ideal for service-based businesses and freelancers. Integration with other tools like G Suite, Stripe, and PayPal for seamless transactions. Mobile app for on-the-go financial management.

- Why it’s a top choice for SMBs: FreshBooks is particularly well-suited for service-oriented SMBs and freelancers in Canada. Its ease of use, coupled with strong invoicing and expense tracking features, makes it ideal for businesses that focus on client-based services.

Each of these accounting software in Canada solutions offers unique features tailored to the needs of different types of SMBs. Whether you need simple invoicing and payroll or a more comprehensive ERP solution like Business Central, there’s an option for every business.

How to choose the right accounting software in Canada for your business

Selecting the right accounting software in Canada can be a game-changing decision for your business, whether you're just starting out or expanding rapidly. With a range of options available, it's crucial to find the software that aligns with your specific business needs and goals. Here are some key factors to consider when choosing the best accounting software in Canada for your company:

Business size and growth potential

- Small businesses: If you're a startup or a smaller company with straightforward accounting needs, a solution like QuickBooks or FreshBooks might be ideal due to its simplicity and affordability.

- Growing businesses: For businesses that anticipate growth or have more complex operational needs, you’ll want to choose scalable software like Business Central that can grow with you. This ensures you won't outgrow your software as your business expands.

Industry-specific requirements

- Some industries require specialized features from their accounting software in Canada. For instance, if you’re in manufacturing or distribution, you might need inventory management and supply chain functionalities. Business Central stands out as the best option for businesses that need a tailored solution with features for specific industries, from manufacturing to professional services.

- If you’re a service-based business or freelancer, a simpler tool like FreshBooks could be more than enough, focusing on invoicing and time tracking rather than inventory or supply chain management.

Compliance with canadian tax laws

- No matter your business size, your accounting software in Canada must help you stay compliant with Canadian tax regulations. Look for software that automates GST/HST calculations and reporting to ensure you're always on top of tax obligations.

- Business Central and Sage 50cloud, for example, offer strong compliance features tailored to the needs of Canadian businesses, with automatic updates for tax changes and detailed audit trails to support your CRA reporting.

Bilingual support

- For businesses operating in Quebec or serving both French and English-speaking customers, bilingual functionality is critical. Make sure your accounting software in Canada offers interfaces and reporting in both languages. Business Central excels in this area, providing full support for businesses in bilingual regions, while some other software may not offer this option.

Integration with other tools

- Your accounting software in Canada should seamlessly integrate with other tools and systems you use in your business. This could include your CRM, inventory management, or communication tools.

- Business Central is a standout in this area, with tight integration with Microsoft products like Power BI for data analysis, Outlook for communication, and Excel for financial reporting. This level of integration can significantly improve productivity and streamline your workflows.

Cloud vs. Desktop-based software

- Cloud-based accounting software allows you to access your data from anywhere, providing flexibility and real-time collaboration, which is especially important for remote teams. Business Central, Xero, and QuickBooks Online are great examples of cloud-based solutions.

- However, if your business prefers the control and security of a desktop solution, Sage 50cloud offers the best of both worlds, combining the reliability of desktop software with the accessibility of cloud features.

Budget Considerations

- While it's important to find accounting software in Canada that meets your business needs, you also need to consider the cost. Basic options like QuickBooks and FreshBooks are more affordable, ideal for small businesses and freelancers with simpler needs.

- If you require more advanced features like full ERP capabilities, multi-location management, or complex reporting, Business Central is a higher-end option that justifies the investment for businesses seeking scalability and long-term growth.

Customer support and training

- When adopting new software, strong customer support and training resources are essential to get the most out of your investment. Look for software providers that offer comprehensive onboarding, help documentation, and responsive customer service. Business Central and QuickBooks are known for their robust support systems, helping businesses quickly get up to speed.

By carefully evaluating these factors, you can make an informed decision about the best accounting software in Canada for your business. Whether you need simple bookkeeping tools or a fully integrated ERP solution like Business Central, choosing the right software will ensure smooth financial management, compliance, and scalability as your business evolves.

In the next section, we’ll wrap up with a summary of why choosing the right accounting software in Canada is essential and how it can drive your business’s growth.

Why Business Central is the best accounting software in Canada for growing businesses

Among the top accounting software in Canada, Business Central stands out as the ideal choice for SMBs that are poised for growth. While other solutions like QuickBooks and Sage 50cloud cater to smaller operations with straightforward needs, Business Central offers advanced capabilities that can scale as your business expands, making it the perfect solution for companies looking to streamline not only their accounting but also their entire business operations.

Here are the key reasons why Business Central is the best accounting software in Canada for growing businesses:

1. Scalability

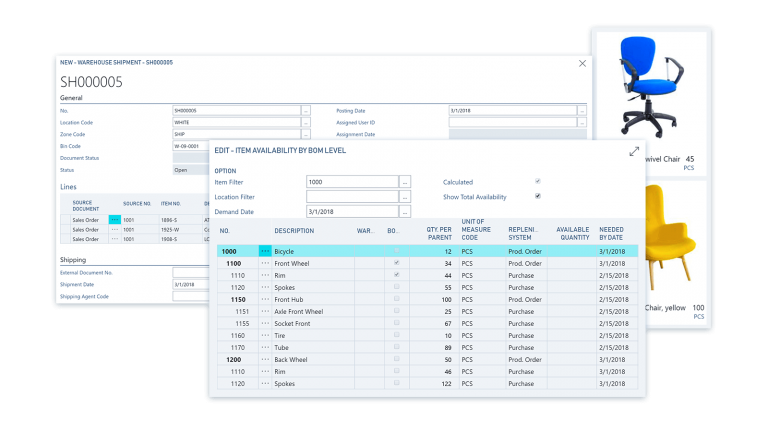

- Business Central is designed to grow with your business. Unlike entry-level accounting software in Canada, which may only serve your needs at the start, Business Central’s comprehensive suite of tools—ranging from accounting to supply chain management—can support your business as it evolves. Whether you’re a small business now or plan to expand into new markets or locations, Business Central has the capacity to support more complex operations.

2. Full ERP Capabilities

- While other accounting software in Canada focuses primarily on financial tasks, Business Central goes beyond that by offering full Enterprise Resource Planning (ERP) functionalities. This means that, in addition to handling accounting and finance, it also integrates sales, purchasing, inventory, and customer relationship management (CRM). This all-in-one solution provides SMBs with a 360-degree view of their operations, streamlining processes and improving overall efficiency.

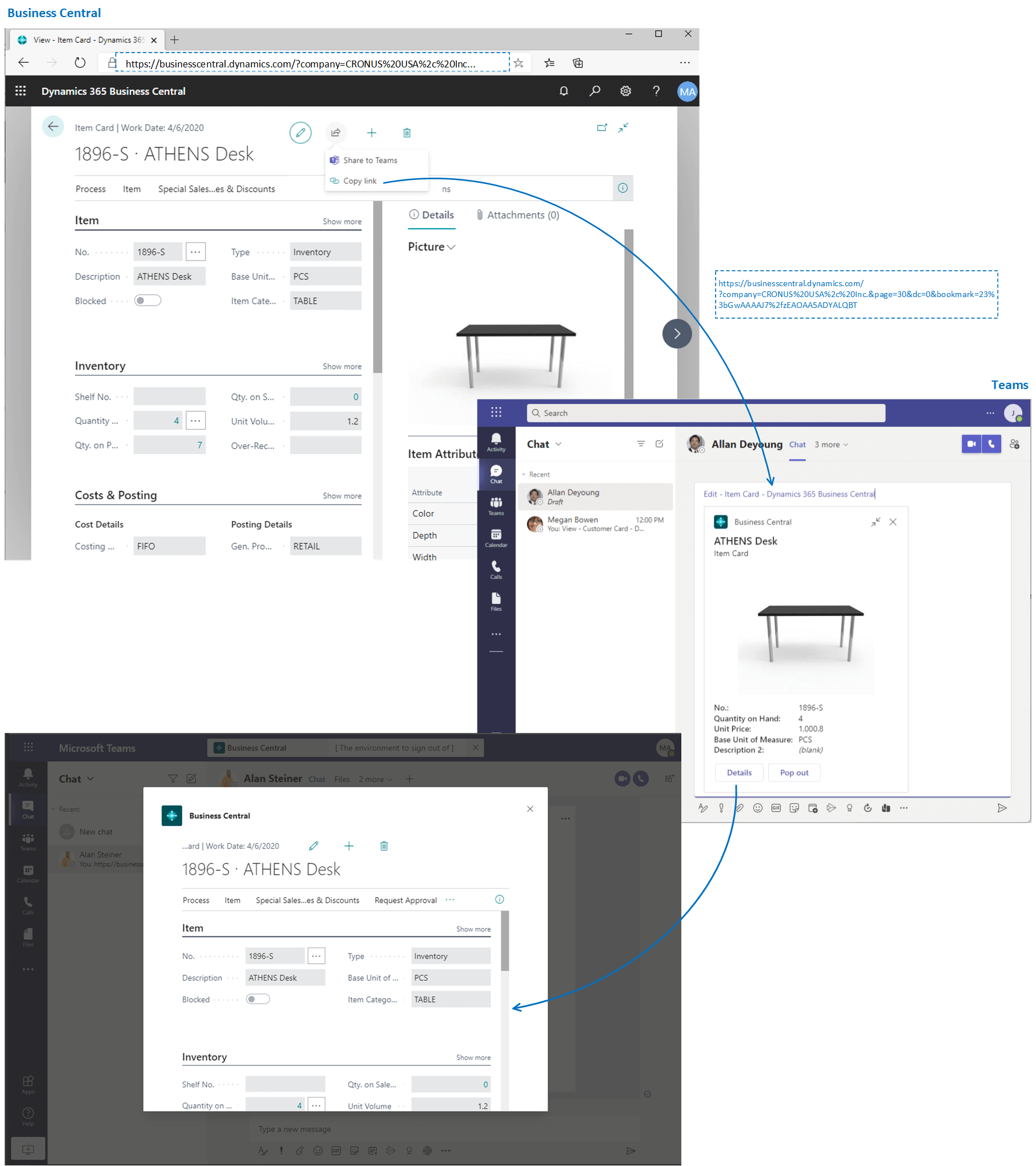

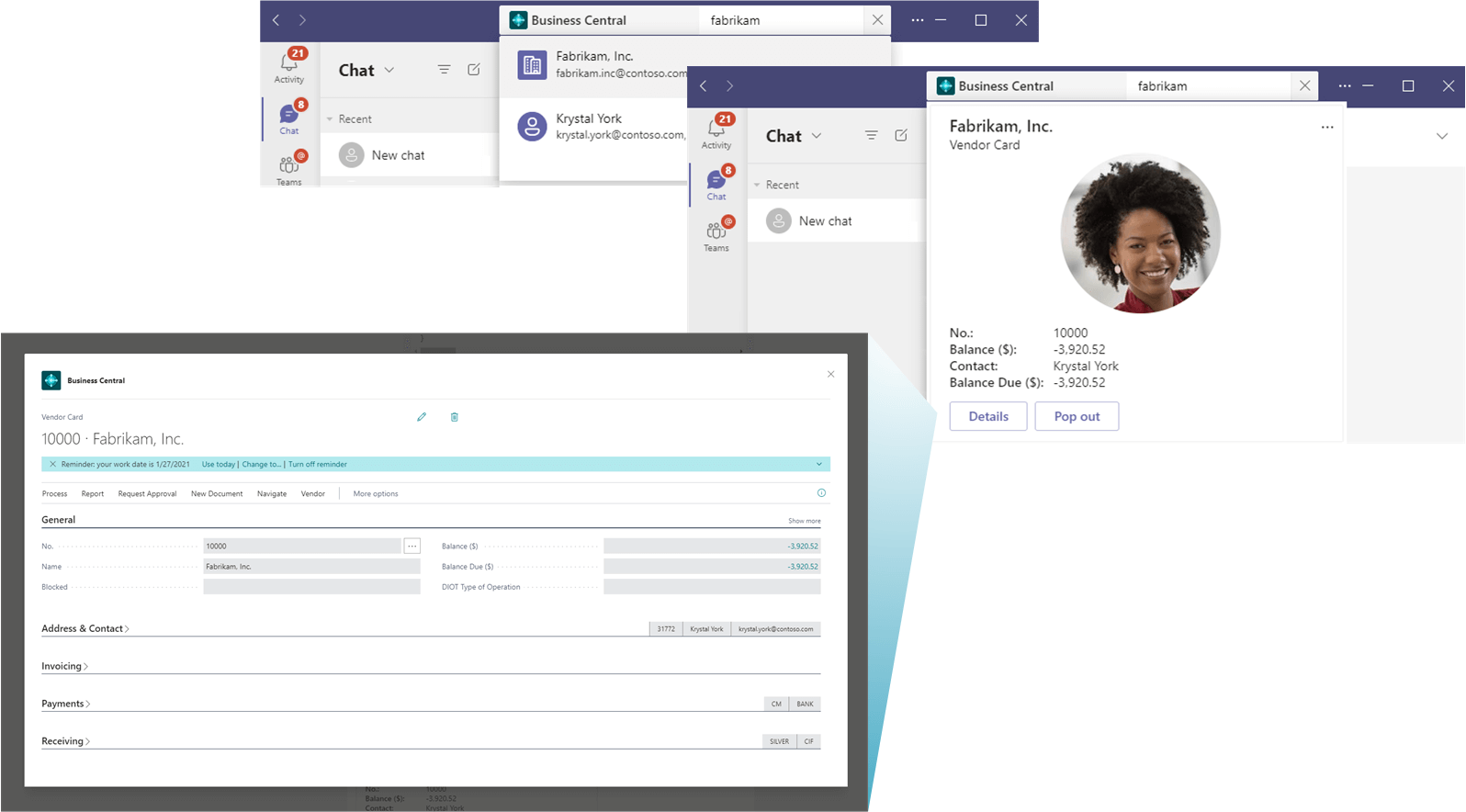

3. Seamless Integration with Microsoft Products

- Business Central seamlessly integrates with other Microsoft products like Power BI, Excel, Outlook, and Teams. This integration allows for enhanced data analysis, real-time reporting, and efficient collaboration across your organization. For businesses already using Microsoft’s suite of tools, this means you can easily connect and automate workflows, resulting in improved productivity and decision-making.

4. Advanced Financial Management

- While many accounting software in Canada offer basic financial reporting and compliance, Business Central takes financial management to the next level. It offers advanced budgeting, financial forecasting, and real-time reporting, which helps businesses stay on top of their financial health. With automated tax compliance for GST/HST and detailed audit trails, Canadian businesses can ensure they remain compliant with government regulations at all times.

5. Bilingual Functionality and Canadian Tax Compliance

- For businesses operating in bilingual environments like Quebec, Business Central offers bilingual support (English and French) to ensure smooth operations. Additionally, it comes with built-in features for Canadian tax compliance, including automatic GST/HST calculations and payroll deductions. This makes it easier for businesses to manage their financial obligations, no matter which province they operate in.

6. Real-Time Financial Insights

- With Business Central, you get real-time insights into your financial data, enabling you to make faster and more informed business decisions. Its customizable dashboards and reports give business owners a clear view of cash flow, profitability, and overall financial performance. This level of visibility is crucial for businesses looking to scale efficiently and strategically.

7. Industry-Specific Solutions

- One of the standout features of Business Central is its ability to adapt to various industries. Whether you’re in manufacturing, distribution, retail, or professional services, Business Central offers industry-specific functionalities that cater to your unique business needs. This flexibility makes it a versatile choice among the accounting software in Canada, ensuring it can serve businesses across a variety of sectors.

Business Central is more than just accounting software in Canada; it’s an ERP solution that empowers growing businesses to streamline and automate their operations. With advanced financial tools, seamless integration with other Microsoft products, and the scalability to support future growth, it’s the perfect fit for Canadian SMBs looking to optimize their financial and operational performance.

Ready to start you digital transformation?

Reach out to our expert sales team to start planning your project.

Empower your business with the right accounting software in Canada

Choosing the right accounting software in Canada is more than just a financial decision—it's a strategic move that can drive growth, improve efficiency, and ensure compliance with Canadian tax laws. Whether you’re a startup, a growing small business, or an established company, the right solution can help streamline your accounting processes, provide real-time financial insights, and support your overall business operations.

For smaller businesses, solutions like QuickBooks, Xero, and FreshBooks offer simplicity and affordability, ideal for companies with basic accounting needs. These platforms can handle day-to-day tasks like invoicing, expense tracking, and GST/HST compliance. However, as your business grows and your needs become more complex, you may find these solutions limited.

This is where Business Central truly stands out. As a leading ERP solution, Business Central goes beyond traditional accounting software by offering a complete suite of tools to manage not only your finances but also your entire business. With advanced financial management features, seamless integration with other Microsoft tools, and the scalability to grow with your company, Business Central is the ultimate choice for SMBs in Canada that are ready to take their operations to the next level.

By investing in the right accounting software in Canada, you can:

- Ensure compliance with Canadian tax regulations and payroll requirements.

- Gain real-time financial insights to make informed business decisions.

- Scale your accounting system as your business grows, without worrying about outgrowing your software.

- Streamline operations with an integrated platform that connects accounting with other key business functions.

Streamline your finances with the best accounting software in Canada

Ready to optimize your business operations? Discover how Business Central can transform your financial management. Contact us today for a free demo and see why it’s the leading accounting software in Canada for growing businesses

Contact Sales

Contact Sales

Liked what you just read? Sharing is caring.

September 19, 2024 by Arianne Pellerin by Arianne Pellerin Marketing Specialist

Driven by an unwavering obsession to optimize processes and revolutionize marketing with innovative ideas, I never stop searching for the perfect solution. My true passion lies in crafting dreamlike experiences by harnessing the full potential of web analytics and cutting-edge digital strategies. As a blog writer for Gestisoft, I bring this expertise to the forefront, focusing primarily on our ERP solutions.