Choosing the right accounting software for small businesses is crucial. With a market saturated with various solutions, finding the one that best meets your needs can be challenging. Business Central stands out among the numerous options available thanks to its robust features, seamless integration with other Microsoft tools, and customization capabilities.

In this article, we will compare Business Central with other accounting software for small businesses such as QuickBooks, Xero and FreshBooks. Our goal is to provide you with a clear and detailed evaluation to help you make an informed decision. We will examine essential features, ease of use, costs, customer support, integration with other tools, as well as scalability and customization. Additionally, we will highlight the competitive advantages of Business Central and the quick implementation packages offered by Gestisoft, specifically designed for small businesses.

Ultimately, the right accounting software for small businesses can transform how you manage your finances, optimize your processes, and help you make more informed decisions for the future growth of your business.

Comparison Criteria

To effectively compare different accounting software for small businesses, it is essential to consider several key criteria. Here are the main aspects to evaluate when making your selection:

Essential Features

- Invoice and Payment Management: Ensure the software allows you to create, send, and track invoices, as well as manage incoming and outgoing payments.

- Expense Tracking: The software should offer tools to track daily expenses and categorize transactions.

- Financial Reporting: Look for features that enable you to generate detailed financial reports for a clear overview of the company's financial health.

- Budgeting and Forecasting: The ability to create budgets and make financial forecasts is a significant advantage for future planning.

Ease of Use

- User Interface: Software with an intuitive interface reduces the necessary training time and increases user efficiency.

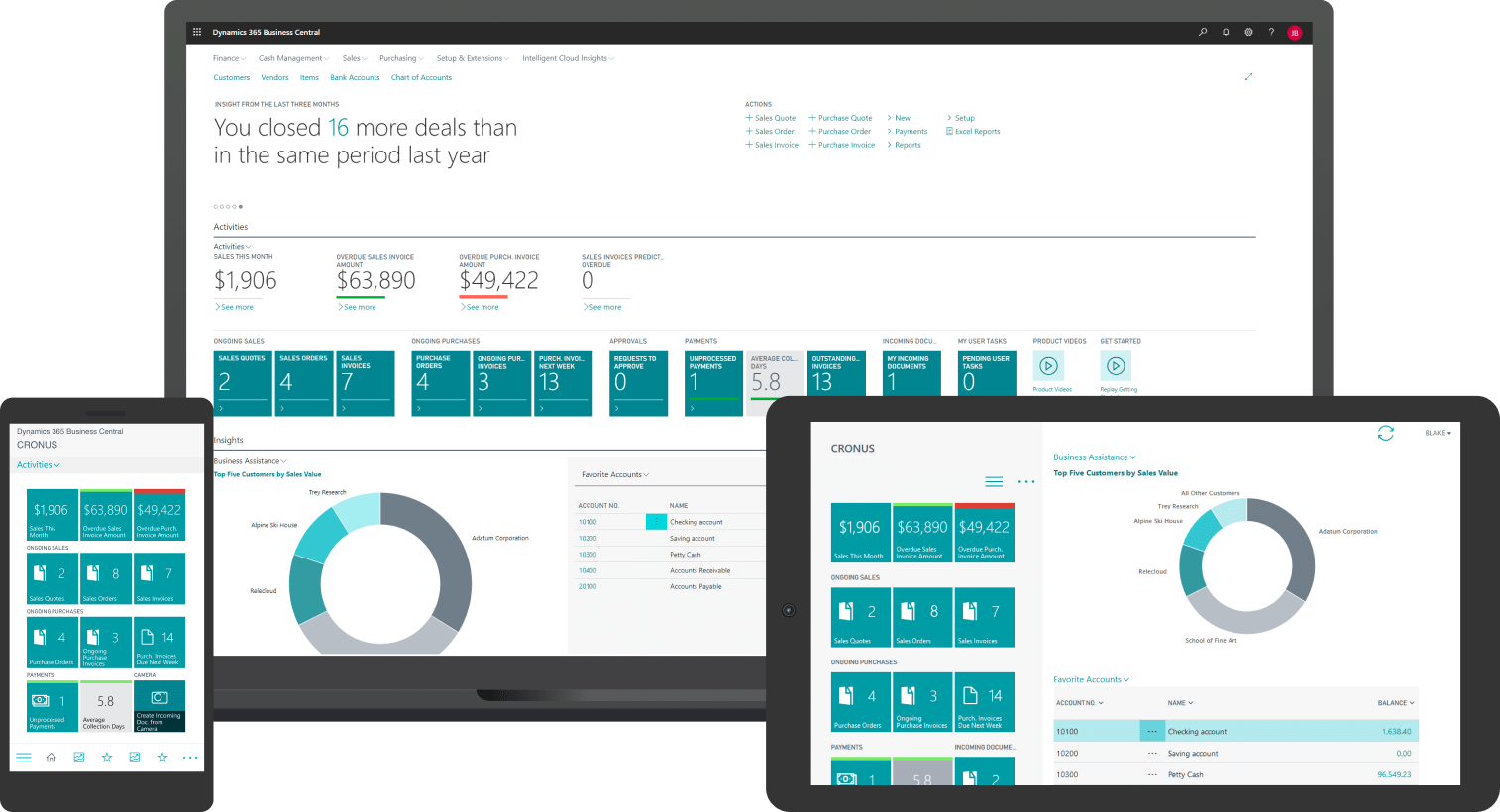

- Accessibility: Check if the software is accessible from various devices (computer, tablet, smartphone) and if it is available in the cloud.

Cost and Pricing Structure

- Pricing: Compare the initial costs and monthly or annual subscriptions. Consider additional fees for advanced features or technical support.

- Return on Investment: Evaluate the cost-benefit ratio based on time savings and improved financial management provided by the software.

Customer Support and Training

- Technical Support: Good customer support is crucial for quickly resolving issues and answering questions.

- Training Resources: Look for tutorials, user guides, and online training to facilitate software adoption by your team.

Integration with Other Tools

- Compatibility: Ensure the software can integrate with other tools and systems your business already uses (e.g., CRM, payroll systems, banks).

- Data Synchronization: The ability to synchronize data between different systems can improve efficiency and reduce errors.

Scalability and Customization

- Adaptability: The software should be able to grow with your business and adapt to its changing needs.

- Customization: The ability to customize the software according to your specific processes is an advantage for optimal use.

By considering these criteria, you will be able to choose the accounting software for small businesses that best meets your needs and facilitates your company's financial management.

Overview of Business Central

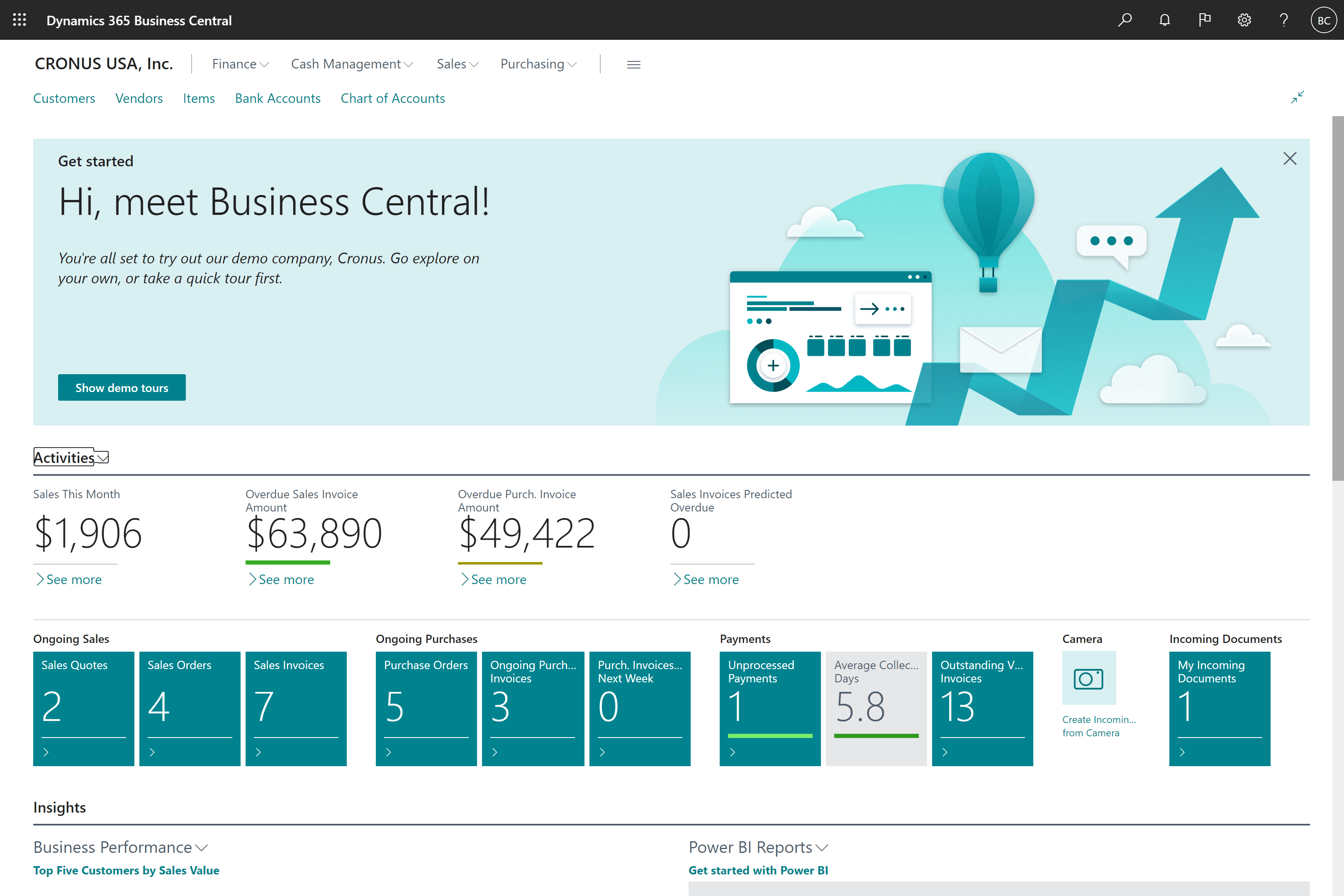

Business Central is a comprehensive ERP solution developed by Microsoft, specifically designed for small and medium-sized businesses. It offers a range of accounting and financial management features that meet the specific needs of small businesses. Here is an overview of the main accounting features of Business Central and the benefits it provides:

Main Accounting Features

- Financial Management: Business Central allows you to manage accounts, bank transactions, cash flow, and cash management, ensuring a clear overview of the company's financial situation.

- General Ledger: The software offers tools for bookkeeping, period closing, and managing accounting entries.

- Sales and Receivables Management: Track customer invoices, manage sales orders and payments, and reduce collection times.

- Purchasing and Payables Management: Track supplier orders, manage invoices and supplier payments, and optimize purchasing processes.

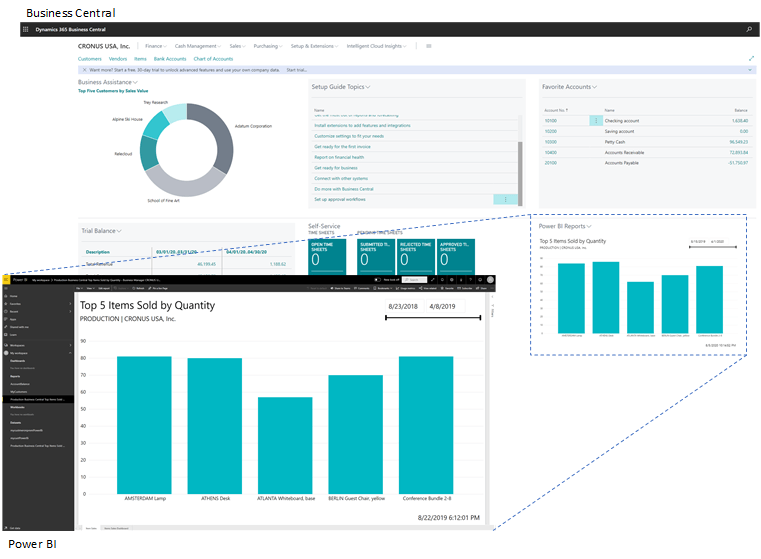

- Reporting and Analysis: Generate detailed financial reports, interactive dashboards, and performance analyses for informed decision-making.

Benefits for Small Businesses

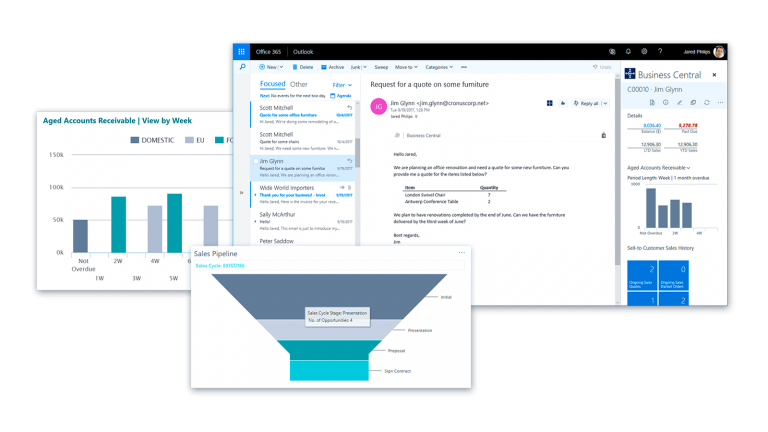

- Seamless Integration with Microsoft Ecosystem: Business Central integrates perfectly with Microsoft 365 (Office 365), facilitating collaboration and operational efficiency.

- Ease of Use: Designed with an intuitive user interface, Business Central reduces the necessary training time for employees and allows for quick adoption.

- Flexibility and Customization: The software can be customized to meet the specific needs of each business, offering a tailored solution.

- Scalability: Business Central is designed to grow with your business, allowing you to add features and users as your company expands.

- Security and Compliance: Microsoft ensures a high level of data security and compliance with current regulations, providing peace of mind for users.

Business Central positions itself as a leading accounting software for small businesses thanks to its advanced features, integration with Microsoft tools, and ability to grow with your business. In the next section, we will compare Business Central with other popular accounting software to help you make an informed choice.

Comparison with Other Popular Accounting Software

To help you choose the best accounting software for small businesses, we will compare Business Central with four other popular solutions: QuickBooks, Xero and FreshBooks. This comparison will be based on features, advantages, disadvantages, and recommended use cases for each software.

QuickBooks

QuickBooks is one of the most well-known and widely used accounting software for small businesses. Developed by Intuit, it offers a comprehensive range of accounting and financial management features designed to simplify daily operations and enable effective financial management.

Features

- Invoice and payment management

- Expense tracking

- Financial reporting

- Integration with numerous third-party tools

Advantages

- Ease of Use: QuickBooks is designed to be intuitive, allowing even users without accounting experience to use it effectively.

- Large User Base and Active Community: A large community means you can easily find help and resources online.

- Numerous Integrations Available: QuickBooks integrates with many other applications, making it easy to connect with the tools you already use.

Disadvantages

- Relatively High Cost for Advanced Features: More advanced features can be costly, which may not be suitable for very small businesses.

- Limited Customization: While QuickBooks is flexible, it offers fewer customization options than some other solutions.

Recommended Use Case

Ideal for small businesses looking for a simple and quick-to-implement solution.

Xero

Xero is a cloud-based accounting solution known for its modern interface and powerful reporting capabilities. Launched in New Zealand, Xero quickly gained popularity worldwide thanks to its collaboration tools and extensive integrations with other applications.

Features

- Invoice and payment management

- Expense tracking

- Detailed financial reporting

- Online collaboration tools

Advantages

- Modern and User-Friendly Interface: Xero offers a pleasant and easy-to-navigate user interface.

- Excellent Reporting Capabilities: Users can generate detailed and customized financial reports to better understand their financial situation.

- Integration with Over 800 Applications: Xero can connect to a wide range of third-party applications, enhancing its utility and flexibility.

Disadvantages

- Initial Learning Curve: New features and the interface may require some time to adapt.

- Limited Customer Support for Basic Users: Xero's customer support is more responsive for paying users, which may be a problem for those using the basic version.

Recommended Use Case

Suitable for businesses needing detailed financial reports and strong integration with other tools.

ERP Self-Assessment Guide

Optimize your ERP software performance by identifying potential areas for improvement.

FreshBooks

FreshBooks is an accounting solution primarily focused on freelancers and small service-based businesses. Known for its ease of use and time and project tracking features, FreshBooks simplifies invoicing and expense management for individual entrepreneurs and small teams.

Features

- Simplified invoicing

- Time and project tracking

- Expense management

- Basic financial reporting

Advantages

- Ease of Use: FreshBooks is extremely user-friendly, allowing users to get up and running quickly.

- Excellent Project and Time Management: Ideal for freelancers and service businesses that need to track time and projects accurately.

- Responsive Customer Support: FreshBooks is known for its excellent customer support, ready to help users in case of problems.

Disadvantages

- Fewer Advanced Features Compared to Other Solutions: FreshBooks may not offer all the features that some fast-growing businesses need.

- Limited for Rapidly Growing Businesses: It may not be as scalable as some other solutions on the market.

Recommended Use Case

Ideal for freelancers and small service-based businesses needing accurate time and project tracking.

General Comparison

- Business Central stands out for its advanced financial management capabilities, seamless integration with the Microsoft ecosystem, automation of accounting processes, scalability, and powerful reporting and analysis features.

- QuickBooks is a solid solution for small businesses looking for quick implementation and numerous integrations. It is particularly suitable for those seeking a simple-to-use solution with a large user base.

- Xero is ideal for businesses needing detailed financial reports and strong integration with other tools. Its powerful reporting capabilities and numerous integrations make it a preferred choice for advanced reporting needs.

- FreshBooks is perfect for freelancers and small service-based businesses needing accurate time and project tracking. Its ease of use and excellent customer support are major assets.

In the next section, we will highlight the competitive advantages of Business Central and why it might be the best choice for your small business.

Competitive Advantages of Business Central

Business Central stands out from other accounting software for small businesses due to several unique advantages that make it a preferred choice for many businesses. Here is a detailed analysis of these competitive advantages:

Integration with the Microsoft Ecosystem

Advantages

- Seamless Integration: Business Central integrates perfectly with other Microsoft tools, such as Microsoft 365 (Office 365), SharePoint, and Teams, allowing for seamless collaboration and centralized data management.

- Increased Productivity: Using a unified ecosystem reduces the time spent switching between different applications, improving employee productivity.

- Enhanced Security: Benefit from Microsoft's robust security measures to protect your financial and sensitive data.

Automation of Accounting Processes

Advantages

- Error Reduction: Automating repetitive tasks such as invoicing, bank reconciliation, and payment management reduces human errors.

- Time Savings: Automated processes allow employees to focus on higher-value tasks such as financial analysis and strategic planning.

- Increased Efficiency: Automation enables faster and more accurate management of accounting operations.

Intuitive and User-Friendly Interface

Advantages

- Ease of Learning: A user-friendly interface allows users to quickly familiarize themselves with the software, reducing training costs and time.

- Improved User Experience: A clear and well-designed interface enhances the user experience, making accounting tasks less complex and more enjoyable.

- Simplified Navigation: Intuitive navigation makes it easy to access various features and tools, enabling more efficient accounting management.

Powerful Reporting and Analysis Features

Advantages

- Detailed Financial Reports: Business Central allows you to generate detailed and customized financial reports, providing a clear overview of the company's financial health.

- Real-Time Analysis: Real-time analysis tools help make informed decisions based on current financial data.

- Customizable Dashboards: Users can create customizable dashboards to track key performance indicators (KPIs) relevant to their business.

These advantages make Business Central a wise choice for small businesses looking to improve their accounting and financial management. In the next section, we will discuss the quick implementation packages of Business Central, an ideal solution for small businesses seeking efficient and hassle-free deployment.

Case Study

Discover how Bédard Ressources improved their accounting efficiency with Business Central.

Download

Download

Quick Implementation Packages of Business Central by Gestisoft

For small businesses, implementing new accounting software can seem like a daunting task. However, with the quick implementation packages offered by Gestisoft, this transition can be carried out efficiently and without hassle. Here is an overview of the benefits of these packages and what they include:

Essential Package

Implementation in 8 weeks at $23,500

Cost: $95.00 per license / per month

Included Features :

- General ledger

- Budget

- Approvals*

- EFT**

- Electronic bank reconciliation

- Multi-currency

- Financial statements

- Power BI dashboards

- Data conversion

Advantages: Ideal for businesses needing a basic accounting solution quickly and at a low cost.

Automation Package

Implementation in 12 weeks at $36,500

Cost: $95.00 per license / per month

Included Features :

- All features of the Essential package

- Invoice capture

- Mobile expense account

- Facilitated credit card management

Advantages: Perfect for businesses looking to further automate their accounting processes to save time and reduce errors.

Project Cost Package

Implementation in 16 weeks at $49,500

Cost: $95.00 per license / per month

Included Features:

- All features of the Essential and Automation packages

- Project costing

- Timesheets

- Revenue recognition

- Project dashboard

- Project data conversion

Advantages: Designed for businesses managing complex projects and needing advanced features for cost tracking and project management.

Benefits of Packages for Small Businesses

Quick and Efficient Implementation

- Detailed Planning: A structured project plan is developed to ensure smooth implementation.

- Minimizing Interruptions: Daily business activities are minimally disrupted thanks to a methodical and planned approach.

- Rapid Deployment: Quick implementation allows businesses to start using the software without prolonged delays.

Training and Support Included

- Training Sessions: Training sessions are included to ensure users understand and can effectively use Business Central from day one.

- Ongoing Support: Technical support is available to quickly resolve any issues and answer user questions.

Reduced Initial Costs

- Predictable Costs: Quick implementation packages offer a clear and predictable cost structure, helping businesses manage their budget.

- Return on Investment: Quick implementation allows you to start benefiting from Business Central's advantages sooner, improving return on investment.

The quick implementation packages of Business Central, offered by Gestisoft, are specially designed to meet the needs of small businesses. By choosing these packages, you can ensure a smooth transition to a powerful and reliable accounting system.

In the next section, we will provide recommendations on when to choose Business Central over other solutions, based on the specific needs of small businesses.

Ready to start your digital transformation?

Contact our sales team to start planning your project.

Recommendations Based on the Needs of Small Businesses

Choosing the right accounting software for small businesses depends on many factors specific to each company. Here are some recommendations to help determine when to choose Business Central over other solutions, based on the specific needs of small businesses:

When to Choose Business Central

Integration with the Microsoft Ecosystem

- If your business already uses Microsoft tools such as Office 365, SharePoint, or Teams, Business Central is the ideal choice due to its seamless integration with these applications, improving productivity and collaboration.

Automation of Accounting Processes

- If you are looking to automate repetitive accounting processes to reduce human errors and save time, Business Central offers robust automation features.

Scalability and Customization

- If your business is growing and you need a solution that can scale with you, Business Central offers scalability and customization options that adapt to your changing needs.

Advanced Reporting and Analysis

- Si vous avez besoin de capacités de reporting et d'analyse puissantes pour une prise de décision éclairée, Business Central permet de générer des rapports financiers détaillés et personnalisés en temps réel.

When to Consider Another Solution (QuickBooks, Xero, FreshBooks)

Detailed Financial Reports and Third-Party Integrations

- If your priority is obtaining detailed financial reports and strong integration with numerous third-party applications, Xero is particularly suitable thanks to its advanced reporting capabilities and extensive integrations.

Time and Project Tracking for Freelancers and Small Service Businesses

- If you are a freelancer or a small service-based business needing accurate time and project tracking, FreshBooks offers specialized features for project and time management.

Simplicity and Quick Implementation

- If you need a simple solution to implement quickly without requiring complex integration, QuickBooks is an excellent option due to its user-friendly interface and large user base.

Importance of Evaluating Specific Business Needs

Before making a final decision, it is crucial to evaluate your company's specific needs:

- Analyze Existing Processes: Identify current accounting processes and the challenges you face.

- Define Objectives: Clarify your short- and long-term objectives for financial and accounting management.

- Consult Stakeholders: Involve key stakeholders in the selection process to ensure all needs are considered.

By considering these recommendations and carefully evaluating your company's specific needs, you can choose the accounting software for small businesses that best meets your requirements.

Choosing the right accounting software for small businesses is a crucial step to improving financial management and supporting your company's growth. Throughout this article, we have compared Business Central with other popular solutions such as QuickBooks, Xero and Freshbooks. Here is a summary of the key points of this comparison:

- Business Central stands out for its advanced financial management capabilities, seamless integration with the Microsoft ecosystem, automation of accounting processes, scalability, and powerful reporting and analysis features. Gestisoft's quick implementation packages offer an efficient and hassle-free transition for small businesses.

- QuickBooks is a solid solution for small businesses looking for quick implementation and numerous integrations. It is particularly suitable for those seeking a simple-to-use solution with a large user base.

- Xero is ideal for businesses needing detailed financial reports and strong integration with other tools. Its powerful reporting capabilities and numerous integrations make it a preferred choice for advanced reporting needs.

- FreshBooks is perfect for freelancers and small service-based businesses needing accurate time and project tracking. Its ease of use and excellent customer support are major assets.

Before making a final choice, it is essential to carefully evaluate your company's specific needs. Consider current accounting processes, define your financial objectives, and consult key stakeholders to ensure all needs are considered.

Explore Business Central with our experts.

Contact our experts for a personalized Business Central demo.

Contact Sales

Contact Sales

Liked what you just read? Sharing is caring.

July 22, 2024 by Arianne Pellerin by Arianne Pellerin Marketing Specialist

Driven by an unwavering obsession to optimize processes and revolutionize marketing with innovative ideas, I never stop searching for the perfect solution. My true passion lies in crafting dreamlike experiences by harnessing the full potential of web analytics and cutting-edge digital strategies. As a blog writer for Gestisoft, I bring this expertise to the forefront, focusing primarily on our ERP solutions.